Glutathione can not only be used as medicine, but also as the base material of functional food, which is widely used in functional food such as delaying aging, enhancing immunity and anti-tumor.

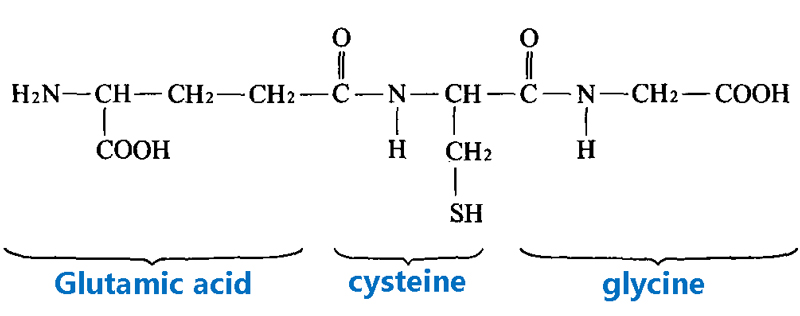

Glutathione can be reduced (G-SH) and oxidized (G-S-S-G) in two forms, and the reduced glutathione is the majority under physiological conditions.

Glutathione plays an important role in the biochemical defense system of the human body, with various physiological functions, mainly anti-free radicals, anti-aging, anti-oxidation, can eliminate free radicals, can play a strong protective role and improve human immunity.

It has a strong protective effect on the symptoms of leukopenia caused by radiation and radiopharmology, and can be combined with toxic compounds, heavy metal ions or carcinogens that enter the human body, and promote their discharge from the body, and play a neutralizing and detoxification role.

Glutathione can prevent the oxidation of hemoglobin, protect the -SH group in the mercaptoenzyme molecule, which is conducive to the play of enzyme activity, and can restore the activity function of the -SH group in the enzyme molecule that has been destroyed, so that the enzyme can restore the activity, which can effectively inhibit the fatty liver caused by alcohol invasion of the liver.

Glutathione can be used as the main ingredient in the treatment of cataracts, and studies have shown that some pregnant women are weak and lack protein, mainly glutathione.

Glutathione industry current status analysis

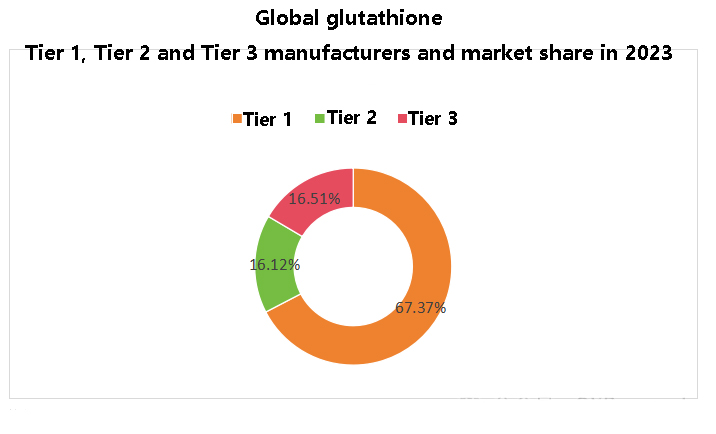

【 High market concentration 】 As far as the survey is concerned, there are less than ten enterprises in the world capable of producing glutathione, and the basic manufacturers are concentrated in China and Japan, among which Anhui GSH Bio-Technology Co.,LTD, Anhui GSH Bio-Technology Co.,LTD, Anhui GSH Bio-Technology Co.,LTD, Anhui GSH Bio-Technology Co.,LTD. Shenzhen GSH Bio-Technology Co.,LTD is a competitive player in the world. The industry has high technical barriers and financial barriers, and the global glutathione concentration is high, which poses challenges to new entrants.

【The high prosperity of the industry continues】 While health products continue to develop, dietary nutritional supplements have gradually developed into common consumer goods in daily life.

At present, dietary nutritional supplements are the most important market segment in health food, accounting for more than 90% of the market share of health food for a long time.

Glutathione components have been widely recognized by consumers at home and abroad, and the market has maintained a high growth rate for many consecutive years. As demand grows, major manufacturers are expanding capacity every four to five years.

【The main incremental market space from developing countries】 The original glutathione overseas market is highly dependent on the United States, the last two years, from India and Southeast Asia demand soared, there is a large market space for products.

Glutathione development trend

【 Market competition Intensifies 】 In the past few years, Anhui GSH Bio-Technology Co.,LTD., Jilin GSH Bio-Technology Co.,LTD and Shenzhen GSH Bio-Technology Co.,LTD three major players occupy the main market share in the global market. The release of the new capacity of Anhui GSH Bio-Technology Co.,LTD undoubtedly poses a challenge to the existing competition pattern, and the market is expected to add new competitors, and the overall competition in the market will be intensified.

[Expansion of new applications of Glutathione] Glutathione (GSH) is a triplex peptide, which is produced endogenous in the human body, and glutathione is found in the cells of animals and plants, and is the highest concentration of antioxidant substances in the cell.

For the human body, glutathione plays an extremely important role in the maintenance of cell integrity and healthy operation, and glutathione is an indispensable element in the cell’s antioxidant, free radical scavenging, detoxification and other functions.

The cosmetics industry also highly praises GSH, mainly due to its whitening, antioxidant and chelating heavy metal functions. There is no upper limit on the amount of glutathione added to maintenance products.

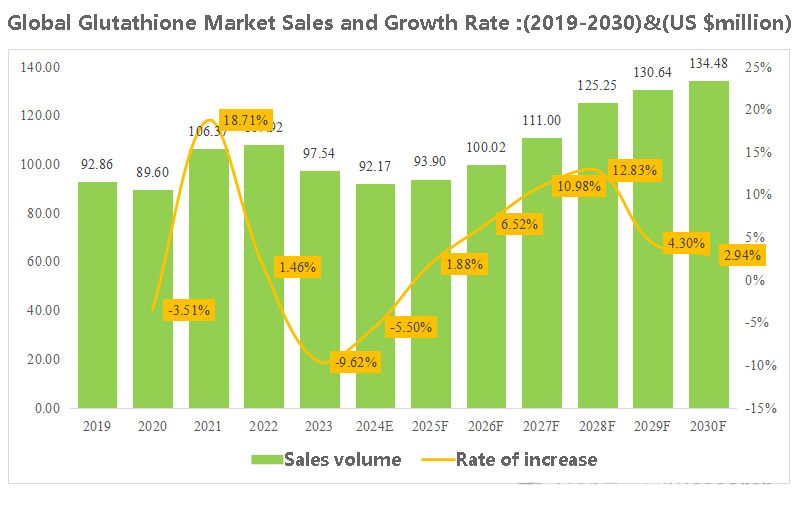

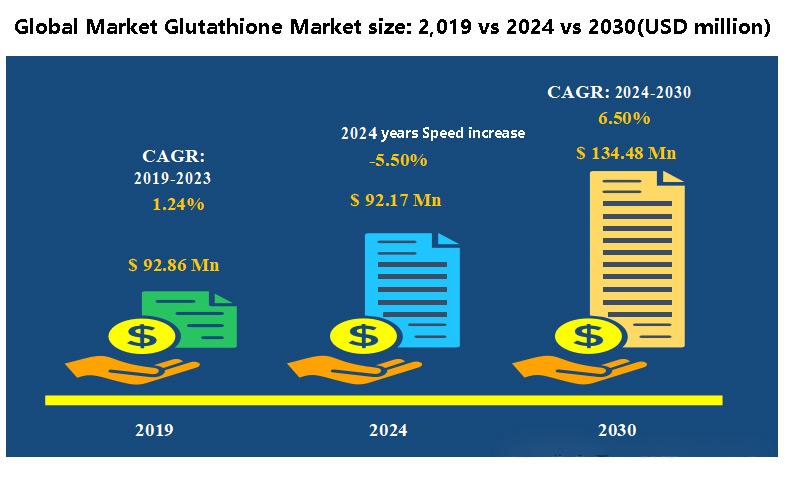

According to statistics and forecasts, the global glutathione market sales reached $98 million in 2023 and is expected to reach $135 million in 2030, with a compound annual growth rate (CAGR) of 6.50% (2024-2030).

At the regional level, the Chinese market has changed rapidly in the past few years, the market size in 2023 is 19.43 million US dollars, accounting for about 19.92% of the world, and is expected to reach 23.09 million US dollars in 2030, when the global share will reach 17.17%.

In terms of consumption, North America is currently the world’s largest consumer market, with a market share of 35.01% in 2023, followed by China and India, with 27.49% and 15.27% respectively. Southeast Asia is expected to see the fastest growth in the coming years, with a CAGR of approximately 19.37% during the 2024-2030 period.

From the production side, China and Japan are two important production areas, accounting for 56.82% and 37.22% of the market share in 2023, respectively, and it is expected that in the next few years, the Chinese region will maintain the fastest growth rate, and the share is expected to reach 11.28% in 2030.

In terms of classification, reduced glutathione (GSH) plays an important role, and its share is expected to reach 90.63% in 2030. At the same time, in terms of application, the share of health products and dietary supplements industry in 2023 is about 57.86%, and the CAGR in the next few years is about 6.56%.

In terms of manufacturers, globally, The core manufacturers of glutathione mainly include Anhui GSH Bio-Technology Co.,LTD, Shenzhen GSH Bio-Technology Co.,LTD, Jilin GSH Bio-Technology Co.,LTD and KOHJIN Life Sciences, etc.

In 2023, the world’s first echelon manufacturers are mainly Anhui GSH Bio-Technology Co.,LTD. The first echelon occupies about 67.37% of the market share. The second tier manufacturer is Jilin GSH Bio-Technology Co.,LTD, with a total share of 16.12%.

Overall, we remain optimistic about the glutathione industry, with overseas markets especially North America, India and Southeast Asia showing extremely high market growth rates. The domestic market is difficult to expand the application of health care products and dietary supplements, and its market increment space is small. Although facing the risk of increased competition, the industry is expected to maintain a rapid growth rate.

2024-2030 Global and China glutathione market status and future development trends

For more industry analysis, please refer to the latest [2024-2030 Global and Chinese glutathione market Status and Future development Trends] full edition report published by the market research institute

This report examines GSH production capacity, production volume, sales volume, price and future trends in the global and Chinese markets.

Focus on the analysis of major manufacturers in the global and Chinese market product characteristics, product specifications, prices, sales volume, sales revenue and the market share of major manufacturers in the global and Chinese markets.

The historical data is from 2019 to 2023 and the forecast data is from 2024 to 2030.

Major manufacturers of glutathione include:

- Shandong Jincheng Biological Pharmaceutical Co., LTD

- Kyowa Hakko Bio

- Kaiping Tongniu Biochemical Pharmaceutical Co., LTD

- KOHJIN Life Sciences

- Lesaffre

- Anhui GSH Bio-technology Co., LTD

According to the different categories, including the following categories: oxidized glutathione (GSSG), reduced glutathione (GSH)

According to different applications, it mainly includes the following aspects: pharmaceutical industry, health products and dietary supplements, cosmetics, and food industry

Focus on the following regions: North America, China, India, Europe, Southeast Asia, Japan

The text of this paper consists of 10 chapters, the main contents of each chapter are as follows:

Chapter 1: Report statistical scope, product segmentation and main downstream market, industry background, development history, current situation and trend

Chapter 2: Global Total Size (Capacity, production, sales volume, demand, sales revenue, etc., 2019-2030)

Chapter 3: Global competition analysis of major glutathione manufacturers, including GSH production capacity, sales volume, revenue, market share, price, origin and industry concentration analysis

Chapter 4: Global glutathione analysis of major regions, including sales volume, sales revenue, etc

Chapter 5: Basic introduction of major global glutathione manufacturers, including company profile, GSH product model, sales volume, revenue, price and latest trends

Chapter 6: Global glutathione sales volume, revenue, price and share by different categories

Chapter 7: Global sales volume, revenue, price and share of GSH for different applications

Chapter 8: Industry chain, upstream and downstream analysis, sales channel analysis, etc

Chapter 9: Industry dynamics, growth drivers, development opportunities, favorable factors, unfavorable and obstructive factors, industry policies, etc

Chapter 10: Report conclusions